Crypto markets are all about volatility. It’s a fact. You would know this if you have ever invested at least in a single cryptocurrency because no coin is non-volatile.

But along with that, the industry is filled with a lot of big scams, and most coins, just fail (as of May 2022, there are 2411 dead cryptocurrencies according to Coinopsy.

Many people have lost a lot of their money because of many crypto scams that happened. I am talking about losing 90% and sometimes even 100% of their investments.

Losing big money (almost life savings) is no small thing.

And this made me realize, that it’s important we know the history of crypto scams and probably learn something from them so that when history repeats in the future, we can stay informed.

So in this article, let’s have a look at some of the biggest crypto scams that ever happened and what we can learn from those!

This is India’s biggest crypto scam ever and the scam is valued at 80,000 bitcoins. Amit Bharadwaj started selling MLM (Multi-Level Marketing) schemes called ‘Gain Bitcoin’ in 2014.

The business model is simple. He scammed people with the concept of cloud mining, where if people invest 1 Bitcoin, they’d get 0.1 Bitcoin for every month.

The promise was that investors would get 1.8 Bitcoin in 18 months if they invest 1 Bitcoin. Seems pretty simple! So, 8000 investors invested in it to ‘Gain Bitcoin’.

“Like a typical Ponzi scheme, the whole mechanism was based on more investors coming into the system and forming a pyramid of investors, who provided funds for repaying to early-round investors!” Source: Iica.nic.in

He even started other ventures like Amit Mining & Blockchain Research Ltd, Coinbank Wallet, and GB Mine and even wrote books like Cryptocurrency mining, Cryptocurrency for Beginners, and Cryptocurrency Trading.

All of this is to build authority in the crypto industry and make people trust him.

Anyways, long story short, he was arrested in 2018. In 2022, he died due to cardiac arrest.

I’d recommend reading this if you want to know the full story in detail. Inc42 created an infographic of his timeline and I think you should look at it.

So far, the cold wallets could not be traced and the lost $2.7 Billion from this Ponzi Scheme wasn’t returned.

Dr. Ruja Ignatova created OneCoin in 2014. Also called ‘Crytpo Queen’, she sold this idea of how OneCoin is better than Bitcoin to 3 million people.

I think what Elizabeth Holmes (Founder of Theranos) is to Silicon Valley is what Ruja Ignatova is to the crypto world.

Of course, Ruja Ignatova’s Forbes cover was part of an ad campaign was not an actually issue of Forbes Magazine.

Ruja Ignatova disappeared in late 2017 and nobody found her since today hence the name ‘The Missing Crypto Queen’. This is how the story went:

She started a scam. Disappeared with a lot of money. People have lost a lot of money. Nobody knows where she is till now. And Bitcoin is still the top cryptocurrency in terms of market cap, as of May 2022.

What most of them didn’t know then was she was involved with BigCoin in 2013 (before creating OneCoin), a multi-level marketing scam.

Ok, let’s talk about the coin and how she scammed people.

First of all, OneCoin is just a centralized currency hosted on OneCoin Ltd’s servers. And she even gave more than a 30 minutes talk on ‘The Blockchain’ topic when the coin didn’t even have a Blockchain behind it in the first place.

And moreover, the coin wasn’t even listed on any other exchanges except on its own platform where it was traded.

The whole concept of OneCoin was to make people buy their education materials which contain tokens that allow people to mine OneCoin. But there is no blockchain chain behind it. No cryptography. No real mining. And to add the cherry on the top, it’s based on MLM.

Yeah, that’s a lot to take.

Just remember that this was an international scam worth 15 Billion dollars and that doesn’t even just involve the concepts of crypto or blockchain. Crazy, right?

Two Narratives here:

Yeah, I know. That’s a lot to digest.

This isn’t a scam like others that made it to this list, but one of the most unexpected events (hack) in crypto history that shaped the future of Ethereum.

If interested: There is even a book called The Cryptopians that covers this topic and more about the journey of Ethereum.

Have you ever wondered why there are two Ethereum listed on the crypto exchanges: ETH & ETC? And the result is because of a DAO hack that happened in 2016.

So, what was this hack all about? First of all, what’s a DAO?

A decentralized autonomous organization (DAO) is a blockchain-based cooperative in which all the members will have the power to govern the projects and get paid based on the efforts they put in. And the rules are set and executed through code.

What centralized companies are to web2 is what DAOs are to web3. No single person controls it. Code is the law.

‘The DAO’ was launched on April 30, 2016, with a token sale that distributed DAO tokens in exchange for ETH and raised more than $150 million from more than 11,000 investors even before the token sale ended (30 days).

And a hacker found a bug in the code and started an attack. In the first few hours of the attack, 3.6 million ETH was stolen ($70 million at the time and Billions of dollars as per the current market price) and then withdrew the attack.

Now, to restore the money, a hard fork (rewrite the software in such a way that the theft didn’t exist) has to be done.

Doing a hard fork means they had to change the rules of the Ethereum protocol. And that also means code won’t be the law anymore and is against the values these things were built for in the first place: immutable and censorship-resistant.

So, not everybody agreed on the decision to hard fork the chain. That ended up in two groups. Or two chains.

The people that didn’t adopt a hard fork (didn’t upgrade their software) – Ethereum Classic (ETC), and the people that adopted the hard fork – Ethereum (ETH).

The Ethereum that we all use today is the ETH, which is the forked Ethereum.

Anyway, who is that hacker that created all this mess? A crypto journalist and former senior editor of Forbes, Laura Shin believes that it was the Austrian Programmer and Ex Crypto CEO Toby Hoenisch.

Crypto became popular in these two years, which attracted a lot of VCs and many early investors (which are now called OGs – Original Gangsters). But crypto also attracted a lot of scammers in those two years.

The top 10 most notorious ICO scams swindled $687.4 Million. That’s a lot of money.

As per a research report by Satis Group, 78% of ICOs were identified as scams, 4% Failed, 3% had Gone Dead, and 15% went on to trade on an exchange.

In the first 2 months of 2018, $1.36 billion was stolen by cryptocurrency scammers.

I am not sure how many people had never returned to crypto as they lost hope because of losing money to these crypto scammers.

What are these ICO scams, anyway? Let’s look at some interesting ICO scams.

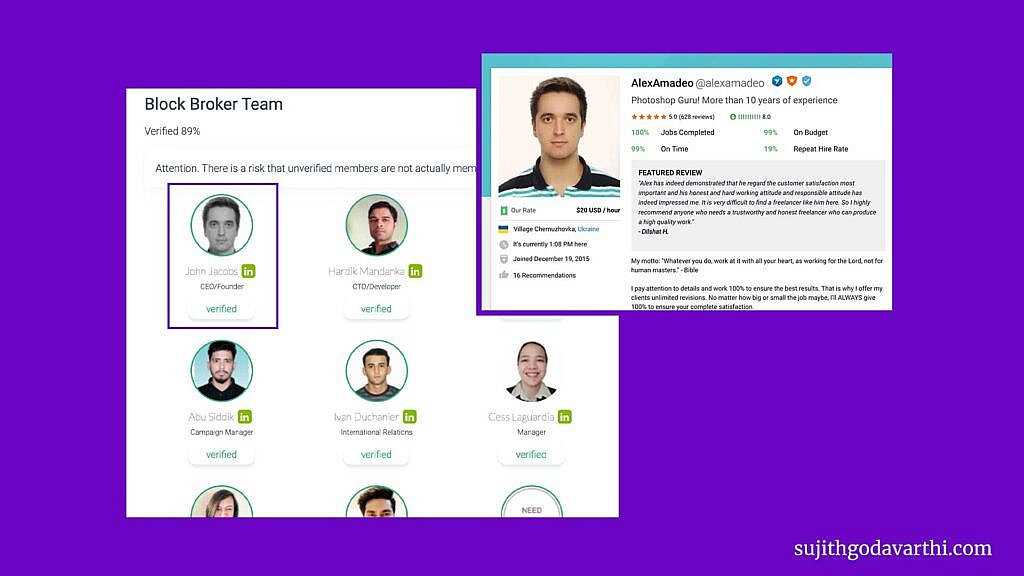

Block Broker claimed that it will be building a platform to prevent investors from buying into exit scams and eliminate ICO frauds.

An exit scam is when someone raises the money to build something and then runs away with the money (disappears) closing everything (website, discord, telegram group, etc.) or selling everything.

Stat: Research shows that the ICO Exit Scams have stolen nearly $100M.

Ironically, the team exit scammed for a price of around 3 million dollars.

Turns out, that the CEO of Block Broker is fake too and stole his bio picture from a Ukrainian photographer: Alex Amadeo

Alteast this was better than Miroskii.

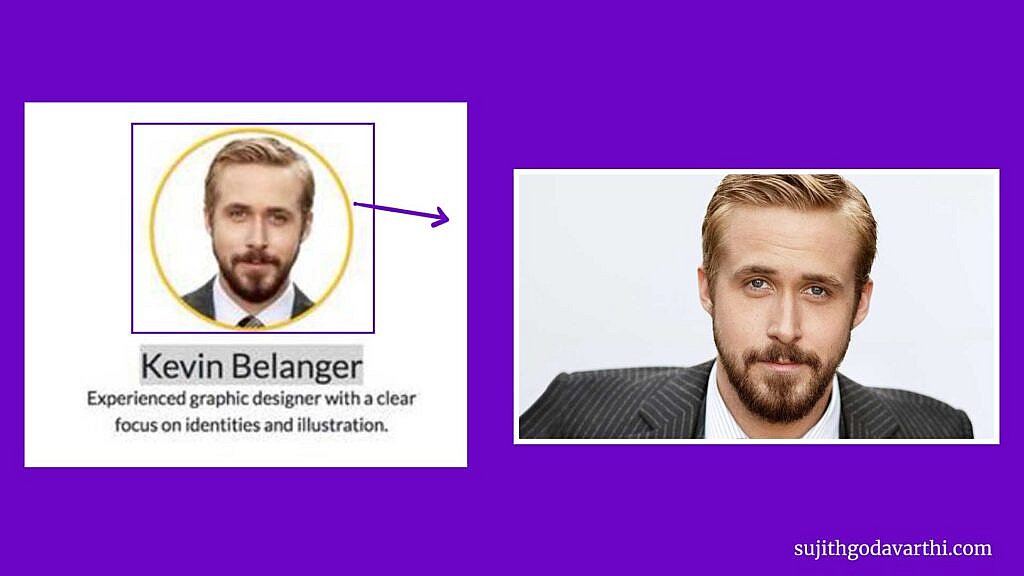

It is an ICO claiming to build a decentralized bank, also an exit scam used the name “Kevin Belanger” as their graphic designer but with the photo of Hollywood actor ‘Ryan Gosling’. They made $830,000 with the ICO.

The lesson we need to learn from this is to look out for more Ryan Goslings!

Anyone can go to a website like This Person Does Not Exist which generates a random image of a person that one can save and use on their website. Forming a fake team with fake people (that look very real) has never been much easier.

So, the next time you see real people on the website, make sure you also check their previous works and research their bio.

Plexcoin promised a 1,354% profit in less than 29 days to investors who participated in the ICO. Turns out this was a scam.

Floyd Mayweather, the American former boxer promoted this ICO on his Instagram account where he wrote “I’m gonna make a $hit t$n of money on August 26th”.

This tells us that we shouldn’t trust celebrities. They don’t know anything better than you or me when it comes to cryptocurrencies.

Just to add more spice to these celebrity endorsements on crypto, Kim Kardashian and Floyd Mayweather (once again!) promoted ‘EthereumMax’ which of course has no relation to Ethereum. Turns out that was a ‘Pump & Dump’ scheme too.

Bitconnect was in the top 20 cryptocurrencies at one point of time in 2017.

It is the true definition of a pyramid scheme.

Before getting into the details, I’d recommend you to watch this stand-up comedy by investor Carlos Matos (also known as Bitconnect’s meme man) at BitConnect’s first and only annual conference, in Thailand. It’s mind refreshing!!

Ok, coming to the scam, Satish Kumbhani and Divyesh Darji (both natives of India) launched Bitconnect in 2016.

This is how Bitconnect worked. You can buy Bitconnect coins in exchange for Bitcoins from their exchange.

These are the steps:

Why most people fell for this is because of a promise of high returns (of course) – 0.25% return per day (And also an extra up to 480% a year).

You bring in more people to deposit Bitcoin on the Bitconnect platform and you get a % of that. And this referral system went on and on and made the people who got into this early, super-rich.

On 17th Jan 2018, Bitconnect was suddenly shut down after receiving cease and desist letters from the Texas State Securities Board and North Carolina Secretary of State Securities Division. And so the price of the Bitconnect coin went down to almost like 80%-90%.

Many investors revealed online that they lost almost their life savings because of this $2.4 Bn Global Crypto Ponzi Scam.

Interesting Read: How a US Couple Allegedly Tried to Launder $4.5 Billion in Bitcoin

Gerald Cotten created QuadrigaCX in 2013, the cheapest, fastest, and safest exchange for Bitcoin trades. By 2017 it become one of the largest crypto exchanges in Canada.

The problem arose when almost $250M of cryptocurrency (owed to 115,000 customers) was locked on his personal laptop before his death in 2018.

If interested: There was a documentary made on the same, titled “Dead Man’s Switch: A Crypto Mystery“.

And the biggest question is: “Did Gerald Cotten really die or did he fake his own death?”.

Some believe that Gerald Cotten faked his own death in order to defraud customers through an exit scam, while others believe that Cotten’s death exposed a Ponzi scheme.

If interested: Netflix released a documentary titled Trust No One: The Hunt for the Crypto King about the story of Gerald Cotten in March 2022.

The reason why I got into crypto is because of NFTs. I heard of them in August 2021 and the tech behind it really got me excited.

So, I decided I have to get an NFT.

Also Read: Where Do NFTs (Non-Fungible Tokens) Get their Value

I looked for some NFT projects, and eventually stumbled on ‘Evolved Apes’. I took some time (3 days) to install Metamask wallet, buy Ethereum on a crypto exchange and move it to the wallet.

And then, right when I was about to buy the NFT, I came to know that the team behind it rug pulled the project. They deleted the twitter and discord. 798 Ether was stolen.

If I had bought an NFT from that rug pulled project, I probably wouldn’t even be writing this article. That’s what ‘getting scammed’ does to most people. It changes their mindset. And most wouldn’t ever return to the game.

Anyways, the point is, rug pulls are quite common. And moreover, there is no legal way to stop it. Because most NFT projects talk about “Underpromise, Overdeliver” and then they just collect the Ether and does nothing.

It’s almost legal. Which is the reason why more than 95% turned out to be a cash grabs.

Mekaverse raised $60M in one day. The fact that one of its NFT sold for 500ETH is shocking! And the floor price is 0.24 ETH as of writing this article. Just imagine that!

Yes, they have an amazing website, and they didn’t delete it. But what’s the point when you can’t build something with the funds. It’s similar to a scam, isn’t it?

Pixelmon raised $70M. It’s an NFT gaming disaster.

Azuki floor price crashed once one of the founders was revealed to be Zagabond – who is involved in a series of failed NFT projects.

The list is never-ending.

There is a lot of drama, hype, controversy, and wealth destruction in the NFT space. People end up losing a lot of money chasing the next Crypto Punks or Bored Apes.

And to add the cherry on top of that, there are a lot of scammers trying to send fake NFT minting website links to discord and Twitter users to make money.

I once minted an NFT from a fake link that I received from a DM (which of course I assumed that it came from the official announcements section) and lost 0.225 ETH. You can read more about that here.

A lot of people doing their homework and working hard just to scam you and me. Keep your wallet safe!!

Some developers created a token called Squid Game token (SQUID). And this happened after the release of the popular TV series on Netflix of the same name.

The idea is that people can buy Squid Game tokens which will allow them to play virtual games that will be designed based on the Squid Game TV series. And the winners would receive prizes (in real money).

But here is the twist! In order to sell those tokens, you need to acquire marbles. Marbles? Yes!! To acquire those marbles, you need to play the games and win them.

But, the games weren’t even created in the first place. They were never launched, nor do the developers have any plans to.

The price of a token at one point in time went to more than $2800 (There were no sellers, only buyers and that’s why the token price went up). And all of a sudden, the token became worthless.

How?

The developers sold all of their tokens (they gave permission to themselves to do that) and walked away with millions of dollars.

Here is what happened:

This is a pure, ‘Pump and Dump’ scheme.

Ok, let’s talk about the largest crypto meltdown of all time. Similar to Bitconnect in 2017 which was in the top 20 list, Terra is also one of the top cryptocurrencies and is in the top 10 list in 2021 & early 2022s.

Before the crash, Terra and UST together had a market cap of around 47 Billion dollars. What happened? This video explained it better.

The price of Terra UST is 5 cents as of writing this article.

The purpose of a stable coin is to stay stable and stay at 100 cents, which UST had failed to, because of the attack and selling the Bitcoin reserves they had didn’t work well (Because they brought Bitcoin at a higher price and they had to sell it at a lower price because when the attack happened it was a bear market).

The ultimate goal is to not become prey to scammers while searching for the next 100x altcoin or an Ethereum or Bitcoin killer.

We have seen the history. And history will repeat itself for sure.

But this time, when history repeats, we are more informed about the scams.