I first heard of Ethereum and NFTs in August 2021. And a month later I got a job as a designer (in the web2 world).

So, from September 2021, I’ve decided to use some of the money that I earned from the web2 world to invest in web3 world. Pretty simple, right?

It all started with buying Ethereum and from then I went deep into the rabbit hole. Over the whole investing period, I’ve got lucky, made some profits but in the end lost a lot because of the mistakes I made and this whole article is all about that so that you can avoid making those.

PS: Nothing I say will ever be financial advice. Always DYOR- Do Your Own Research (Although nobody knows what does that even means).

Taking loans to invest in cryptocurrencies is definitely not a good idea.

In the beginning, you probably might feel like the prices of the coins/NFTs that you want to buy are gonna go up forever. And that creates a FOMO to take loans and use that money to invest in crypto.

But the truth is Crypto is highly volatile.

A lot of pump and dumps happen very quite often, especially with NFT floor prices and altcoins.

So there are better chances that you probably get many chances to buy the coins at the prices you might want. Well, at least I got those chances. But the thing is I didn’t have the cash during the ‘dip’ because I’d already taken loans by then only to buy at a higher price.

FOMOing to buy something is probably ok. But, never ever FOMO and take loans to buy something. Always use your own money to invest, and invest only the amount that you are ok to lose.

You trade crypto. You flip NFTs. You use staking rewards you earn from Defi pools to buy new coins.

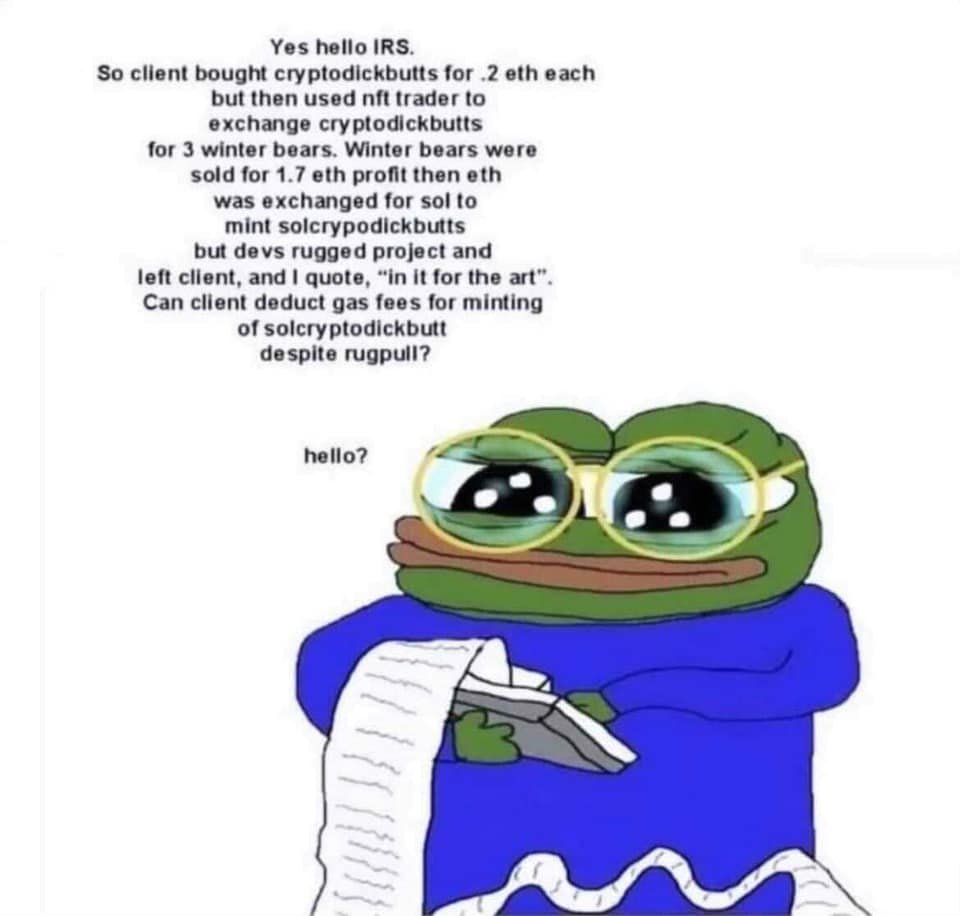

Well, doing all of these creates a lot of transactions. So, what? Well, in the end, all of us need to pay taxes (based on the tax rules in the country live in). The capital gains calculations become so hard if all these transactions aren’t checked regularly.

Just connecting your wallets & crypto exchange accounts to a tax application like Cointracker isn’t going to be enough.

You need to be checking the airdrops you receive, staking rewards you earn, and also validate transactions (manually sometimes – the software isn’t perfect always). Doing this at least once or twice a month gives a good idea of how much you earned, how much taxes you owe so that you can be ready for the taxes when the time comes.

Let me give you an example: I claimed my ENS airdrop amount when the price is high. But the point is I didn’t sell it (I didn’t know then that claiming is a taxable event) and the value went down later. So I had to pay a lot of tax for that mistake I made.

When you claim, how much you claim, and how much you sold for, these things matter a lot in taxes.

Learn more about these taxable events and make sure you check the crypto transactions regularly.

Going all-in on crypto is thrilling. Reinvesting profits is fun. But no liquidity when you have to pay the tax isn’t fun.

Because you have to sell your positions, and that is probably gonna ruin your portfolio if the market is down.

I bought an NFT because some influencer from Twitter hyped up the project. And I listened to him. And you know what happened next, right? I lost a lot of money on that.

Don’t make buying decisions on someone’s opinion and the hype that you see around social media. The dumbest thing you can do is invest based on other people’s shills.

Look at what happened with Mekaverse NFTs. Most people paid 8 ETH only to resell that for below 1 ETH.

And on the other hand, look at what happened with Bored Ape Yacht Club. Nobody knows that the floor price would hit 100 ETH in the future when people minted those. But it happened.

Yes, luck is a big factor in these trades. But, in my opinion, betting on the fundamentals of a project should be the focus.

Why do you want to invest in that coin? Why do you think that particular NFT project can moon in the future? Ask yourself. Think. Research. Analyze. Then invest. And don’t forget this: Invest with your own money.

Yes, nobody can freeze the funds you have in your Metamask/phantom wallet. But what’s the point if you lose your seed phrase.

Not Your Keys, Not Your Coins. Keep it safe and secure.

And talking about scams, I once lost 0.225 ETH because I’ve minted 3 NFTs from a fake link. The scammer sent me the link via DM using the name & profile of the Discord group I joined.

Make sure you double-check the URLs when minting NFTs and always use a new wallet.

Here are some helpful links that contain some very useful and important info on how to protect your assets and wallets:

How is “Not saving money” related to “ruining crypto worth”, you might ask. Well, I’ve two reasons:

Reason 1: If you save enough money, you don’t have to liquidate cryptocurrencies/NFTs when in an emergency. It can come in the form of taxes, medical/health issues, losing a full-time job, world war 3 (who knows?), a world pandemic, etc. Make sure you are ready for those things by maintaining an emergency fund.

Reason 2: As we all know, Crypto stuff is highly volatile. And that means there is a high probability that one can get a lot of chances to buy during the dip/crash. But what’s the point if you don’t have any money to buy the dip?

There are a lot of ways to make money from web3. But so are the ways to lose money. I hope you will learn something from the mistakes I’ve made in the first 7 months of my web3 journey.