Real Estate is great for generating passive income. If you buy a house, you can earn money by renting it.

Now, the problem with investing in Real Estate is the liquidity issue. If you buy a house for a million dollars by taking a 60% mortgage, it leaves you with 40% equity that is just stuck in real estate. The money is not doing anything.

Now, what if you can use that stuck amount to earn some more extra yield? What if you don’t need a million dollars to be a real estate investor?

Welcome to CitaDAO.

Disclaimer: This article is for discussion purposes only and is not an offer to sell or the solicitation of an offer to buy securities, insurance, or other financial products. I encourage you to always do your own research and come to your own conclusions.

CitaDAO is a decentralized real estate platform that is tokenizing real estate assets and putting them on a blockchain.

If you look at Bitcoin, it is backed by the people’s belief in the math and technology behind it. With stable coins, they are backed by FIAT (US dollar).

Now the core ideas behind CitaDAO are:

Real Estate is a 280 trillion dollar market but the problem with it is a lot of the capital is locked. That means it is not doing anything, not earning any interest.

And it is definitely not an easy-to-enter investment space. Investment capital is one of the biggest barriers to entering in Real Estate.

With CitaDAO, by being the holder of Real Estate tokens (each token represents fractional ownership of a property) you’ll own some parts of that property and at the same time enjoy the extra yields by leveraging Defi (more on that later).

Related: Why to bring Real Estate on chain

Ok, but what are these real estate tokens? And how are real-life assets tokenized and put on the blockchain?

Now let’s talk about IRO: Introducing Real Estate On-chain. This process determines whether the Real Estate property will be tokenized or not.

Before a property can be listed for IRO, professional lawyers will conduct appropriate due diligence to make sure that said property can be sold or not and there are no legal problems associated with doing so.

An investor must commit some USDC (a stable coin) during the IRO, and if the total amount from all the investors reaches the target that is set, the IRO will succeed.

Investors will get back RETs (Real Estate Tokens) based on the amount of USDC they have committed in the IRO.

And that’s not all. In addition, investors will receive extra rewards (aka IRO rewards) from the reward pool based on the contribution. The total rewards are based on the % of your contribution to the total contribution, updated every day.

Related: How are IRO rewards calculated?

If the IRO fails, the investors will get back their USDC, but without any rewards. Here is a graphic showing the IRO mechanism:

From verifying the property to an investor receiving the tokens & rewards, here is the whole breakdown:

Remember that RETs are specific to their property and are backed by their corresponding real estate. That means, for different properties there’ll be different RETs.

Related: How to participate in the IRO

Over the past years, Defi (Decentralised Finance) has seen some tremendous growth and all thanks to the web 3.0 developers and active user participation.

In the case of CitaDAO, Defi is being used to drive demand and unlock capital efficiency in real estate. CitaDAO are trying to create sustainable yield farms that will be powered by real estate globally(How long do you think all the protocols with 100K APY% will be sustainable? Not much longer, definitely).

So, any individual who holds the RETs can easily use Defi pools and generate some extra yield.

The HODLers of RETs benefit in 3 different ways:

As you can see in the name itself, CitaDAO is a DAO (Decentralised Autonomous Organisation) and what that means is no single founder controls the whole operations. It’ll be controlled by the people. To be more specific, the governance token holders.

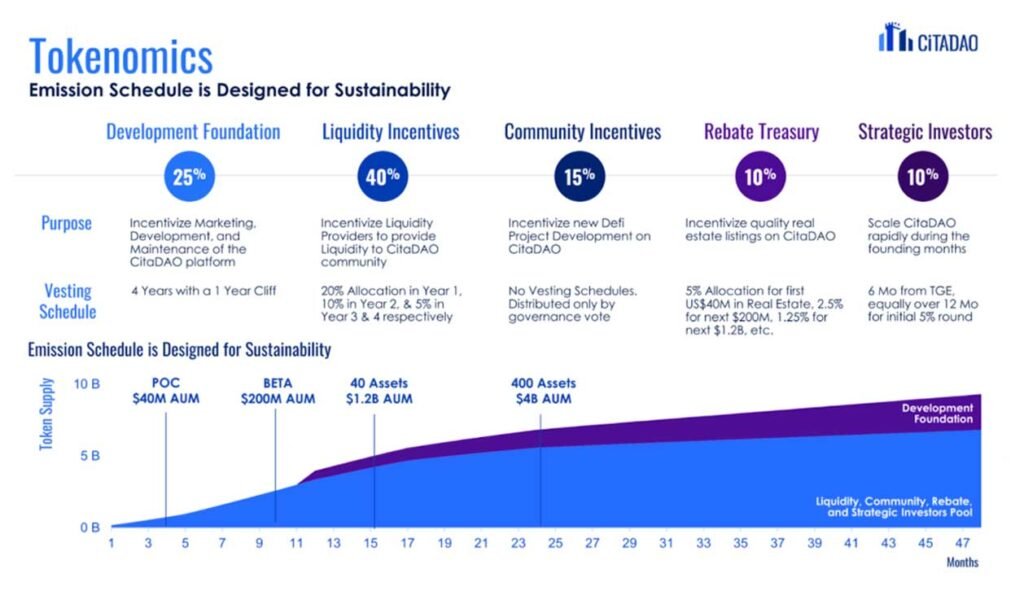

And the governance token is different from RET. Here is the tokenomics for the CitaDAO governance tokens:

CitaDAO will have a hard cap of 10B tokens and out of which 40% will be used for LP(Liquidity Pool) rewards. And that means you can earn some CitaDAO Tokens by providing your RET tokens to the LPs. And that’s what we mean when we say “Leveraging Defi”.

And here is a bonus: The CitaDAO treasury will hold 2% of all Real Estate Tokens that have gone through a successful IRO. Therefore providing better downside protection for RET holders relative to holding the real estate directly in real life (Off-chain).

Related: CitaDAO Use Cases

If you are an owner of a property, you can list it on CitaDAO and get it fractionalized in an IRO so that you can use your 100% cash on other uses or buy back some tokens and use only some cash for other uses.

If you are an investor, you can participate in an IRO by committing USDC and you’ll be receiving RETs along with the reward amount in USDC, assuming that the IRO needs are matched. Then you can use those RETs and put them on Liquidity Pools to generate more yield.

We have just entered the tokenized economy and sooner or later everything will be tokenized. It’s just a matter of time. So, why not Real Estate? Why not now? And moreover, why not leverage Defi?

Thanks for reading. For more info, you can refer to the whole documentation here.